The rising cost of materials and mortgages has impacted the building of new homes, causing a decrease in new home construction.

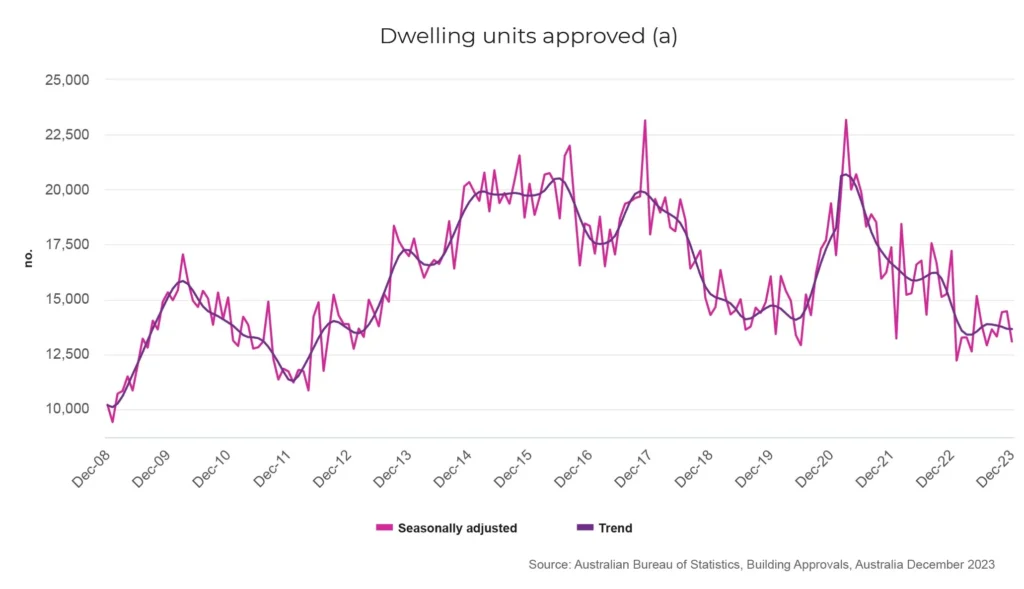

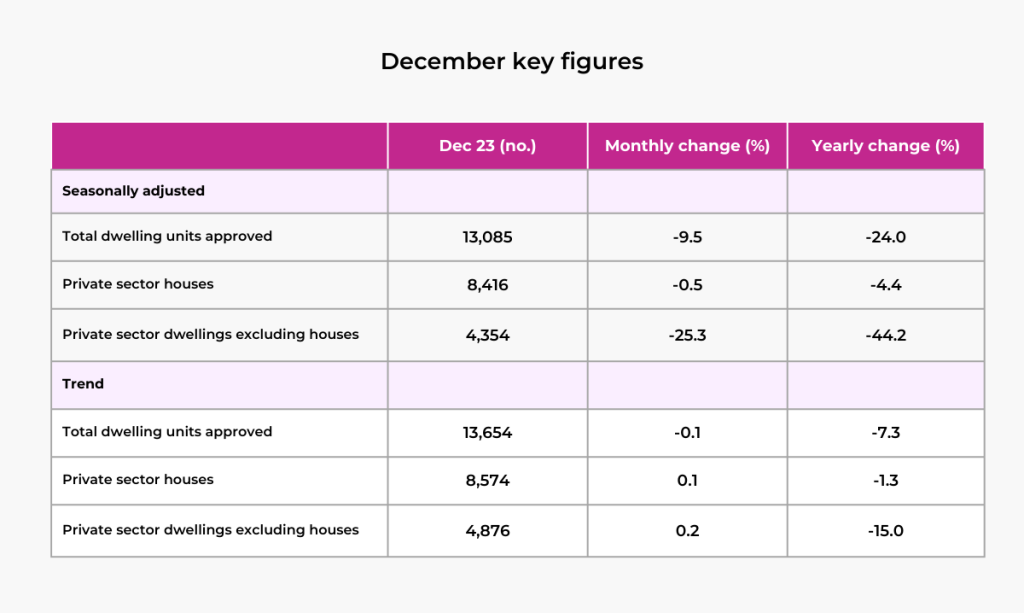

According to the Australian Bureau of Statistics (ABS), the seasonally adjusted estimate for approved dwellings fell by 9.5% in December 2023 after a 0.3% rise in November.

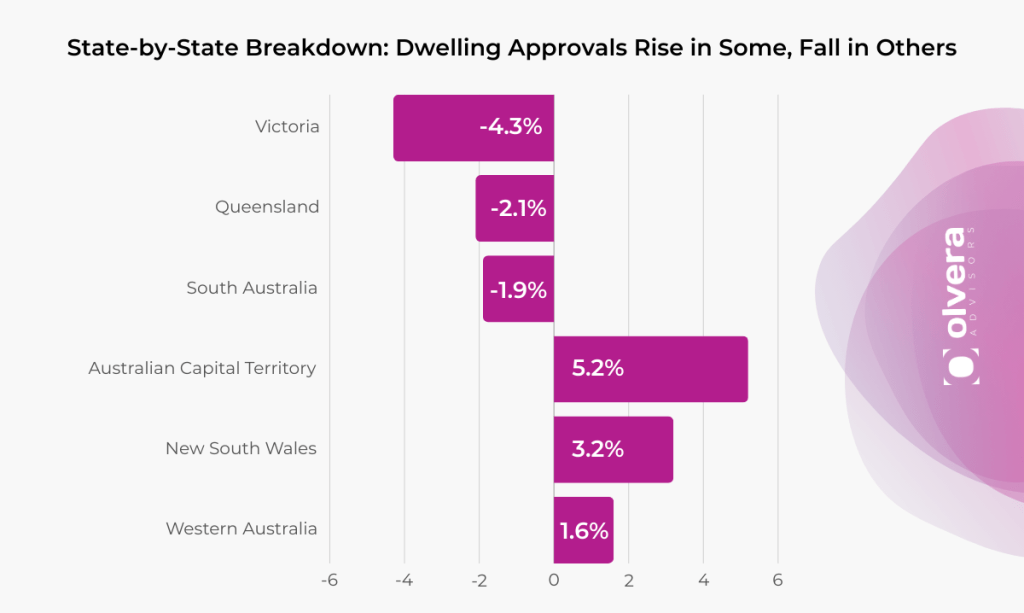

Looking at the approvals for total dwelling by state, the numbers were mixed. Falls were recorded in approved dwellings for Victoria, South Australia, Queensland, and Tasmania, while Western Australia, Australian Capital Territory, and New South Wales rose.

The building and construction industry has been hit hard by rising interest rates, impacting consumer confidence in the housing market. Additionally, building costs has also risen significantly, impacting affordability rates for first home buyers.

In the past 18 to 24 months, housing prices have jumped significantly, increasing at a median rate of $60,000 in 2 years. Demand for housing has played a part in the increase in prices which has risen sharply fuelled by significant population growth and a post-COVID lockdown boom.

Builders feeling the impact

Housing Industry Association senior economist Tom Devitt says that while there is expected to be sustainable work for 2024, builders and suppliers are noticing fewer new projects.

“Since the RBA’s first cash rate increase in May 2022, sales of new homes have tumbled. A number of earlier projects are also being cancelled, with banks withdrawing finance in the face of soaring building costs and shrinking home buyer borrowing power.”

“At the moment, there’s still quite a bit of work under construction from previous years, especially during the pandemic,” he said.

“But that pipeline is now shrinking quite rapidly as a result of the reduced levels of new work entering the pipeline.”

Devitt claims that new home buyers are being “squeezed out of the market” because of mortgage stress and economic uncertainty. As a result, some planned new home projects had to be suspended or cancelled.

“Especially in the multi-unit market, with units and townhouses running into material and labour constraints, and finance constraints, a lot of those projects are being put on hold,” Mr Devitt said.

“What we’ve noticed in our own surveys of the industry is that a lot of houses that have already been previously sold are actually having to be cancelled …. Banks are finding themselves unwilling to lend for projects where costs have increased so much since the initial contract was signed.”

Although the demand for new homes is strong, economic forces such as the instability of building costs and the cost of finance prove to hinder new builds. It’s estimated that these pressures will not go anywhere for the next 12 to 24 months.

Prices of items needed in new home construction have significantly increased from their pre-pandemic levels. For example, terracotta tiles have risen 62% since December 2019, reinforcing steel has risen 59%, and timber windows have soared 62%.

Additionally, extreme labour shortages have put many builders in a tight spot. Competition for workers is fierce, with many smaller builders losing out in the talent pool. It is a negative cycle of employment that reduces their productivity and increases their cost.

According to Adelaide Timbrell, ANZ Research’s senior economist, short-term changes, such as higher home prices or lower construction costs, would help builders, but this is unlikely to happen.

“The economic forces are not in favour of housing supply,” said Timbrell

“Even though housing prices have started to rise, they haven’t really offset the increase in cost and risk to the building sector, particularly of units, townhouses and larger developments.”

Ms. Timbrell said that even with improved conditions that promote the viability of residential projects, construction companies will still have to compete with other sectors buying the same resources.

Key takeaways for builders and contractors

Although builders can look forward to the government plans to build 1.2 million homes over the next five years, economists and financial analysts deem this target a stretch. We predict the following factors will impede new house builds in the next two years:

- Rising interest rates and cost-of-living pressures affect housing affordability.

- More consumers to hold existing project builds or choose not to build for the time being.

- Rising costs of building materials will push up the costs of projects.

- Increasing competition from other builders to secure labour in a tight market.

- Mass levels of migration will surpass the existing supply of housing.

- Stronger demands for established homes are inevitable due to the high costs of building and the length of approval times.

In 2023, we’ve seen developers like Porter Davis fall into voluntary administration and cease work on existing builds. Hence, developers must adapt to this changing market with agility and flexibility.

By assessing each project’s profitability, negotiating with suppliers, and even looking for alternate builders to take on the project, losses can be minimised. Builders can continue focusing their resources on other viable work while restructuring their business.

Olvera Advisors helps businesses stay ahead in a dynamic environment with bespoke restructuring solutions. Explore our blog for more insights on navigating the financial complexities of this changing industry.

References:

- Calls for structural reforms to stimulate housing construction after post-COVID slowdown

- Construction set for a slowdown in 2024 despite November lift in approvals

- New home building slumps to decade low

- Housing targets at risk as building stalls at decade-low pace

- Australian Housing Crisis: The High Price We’re Paying

- Building Approvals, Australia – December 2023