Lettuce

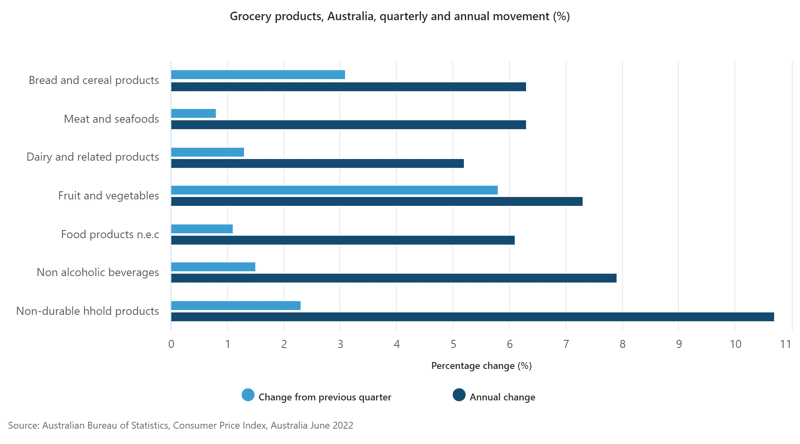

Over the past few months, lettuce prices have been skyrocketing, with social media users posting pictures and memes of iceberg lettuces ranging from $10 to $12, well above the usual price of $2.80. This is not new, and it not only lettuce. According to ABS, price rises were seen across all food and non-food grocery products in the June quarter, reflecting a range of price pressures including supply chain disruptions and increased transport and input costs. Figure 1 shows the quarterly and annual percentage change in grocery products in Australia.

So, why the jump in food supply prices?

Global supply chain disruptions

The impact of the pandemic and global supply chain disruptions has been many-fold and has adversely impacted almost every part of the food supply chain, from production to processing and retail. However, the most obvious one is transport costs. Energy prices have also climbed sharply due to many Western countries sanctioning Russian oil and Gas. Energy prices rose a whopping 41.6% from June 2021 to June 2022. This is the largest 12-month increase since 1980, further exacerbating the already-high food production and transportation costs triggered by the pandemic.

The war in Ukraine

Russia and Ukraine are some of the largest producers of grain in the world, accounting for 30% of all wheat exports combined. However, the war in Ukraine has devastated both its agricultural production and export capabilities, with its cargo exports have decreased 92% from a year ago. Countries previously sourcing grain from Ukraine will now be competing for Australian grains, in turn pushing prices up in Australian domestic market, which will directly reflect on the hospitality and restaurant sectors.

Climate change

Finally, fruit and vegetables rose 5.8% due to heavy rainfall and flooding in key production areas of New South Wales and Queensland disrupting domestic supply.

How does this impact the hospitality sector?

The cost of food is one of the most important operating costs for a restaurant. The lingering pressure from food inflation – with no end in sight – is:

- squeezing restaurants’ operating margins;

- pushing restaurant owners to adjust menu pricing; and

- passing the cost on to the customer.

According to ABS, the cost of meals out and take away foods has increased by 4.7% over the last 12 months, with beef prices rising by 9%, which has some restaurant prime steaks at $70.

Finding it hard to get a change out of $200 for a dinner for two, consumer spending has fallen as restaurant-goers have been changing their dining behaviour, declining to patronise premium restaurants in favour of cheaper options and avoiding higher margin items such as entrees, desserts and beverages, placing downward pressure on profit margins and industry revenue.

Labour and Leases

An expert interview with Henry William Lawyers

We spoke to Henry William Lawyers to gain more insight into the challenges of the changing labour and leasing regulations, which are currently present in the hospitality industry.

Labour

According to HWL, the Fair Work Commission (FWC) has decided to significantly increase the national minimum wage (NMW) by $40 this year, in response to the sharp rise in inflation and the strong labour market in Australia. As of July 2022, the NMW increased to $812.60 per week or $21.83 per hour.

In making its decision, the FWC took into consideration rising inflation and its impacts on both businesses and workers. For the hospitality industry, the FWC recognised that the exceptional circumstances that continue to face the industry and decided to delay the wage increases to relevant modern awards such as the:

- Hospitality Industry (General) Award 2020

- Registered and Licenced Clubs Award 2020

- Restaurant Industry Award 2020

until 1 October 2022. However, whilst this delay in wage increase can assist the hospitality industry, the sector continues to be distressed by severe labour shortages and rising costs, which has the potential to significantly impact an industry already operating on thin margins.

Now is the time to prepare and plan for 1 October 2022. To minimise any negative impacts on business and manage the increase in labour cost, Henry William Lawyers recommend that owners review the following and any effect these may have on business costs:

- current wages and classifications of employees;

- other entitlements such as penalty rates, overtime, etc; and

- any annualised salary arrangements.

Leases

The Retail and Other Commercial Leases (COVID-19) Regulation 2022 (the Regulation), which provided certain protections for lessees under leases impacting impacted by COVID-19, lapsed on 30 June 2022. Henry William Lawyers recommends that lessees prepare for the long-term impacts of these protections by giving special consideration to:

- if any breaches of the lease have occurred after 30 June 2022, or if there are potential issues that may now give rise to the breach of the lease, eg. breaches no longer protected by the COVID-19 measures;

- any outstanding rent, which may now be due and payable, or renegotiations for unpaid rent; and

- lessors may now seek to negotiate increases in rent.

If you are experiencing any of these issues, please get in touch with us below and we can help!